checkout integration

Version: 0.0.1

Released: 2023/12/1

Introduction#

This document describes the Checkout integration procedures between Checkout service and the website for e-commerce merchants..

General Information#

Checkout service is a fast and easy way to create a secure payment page. It allows collecting and submitting payments and sending them for processing.

To use the Checkout service on the site you have to perform integration. Checkout integration provides a set of APIs that allow customizing payment processing for the business. These protocols implement acquiring payments (purchases) using specific API interaction with the merchant websites.

The API requires request data as FormData and some API requires with JsonData

Checkout process#

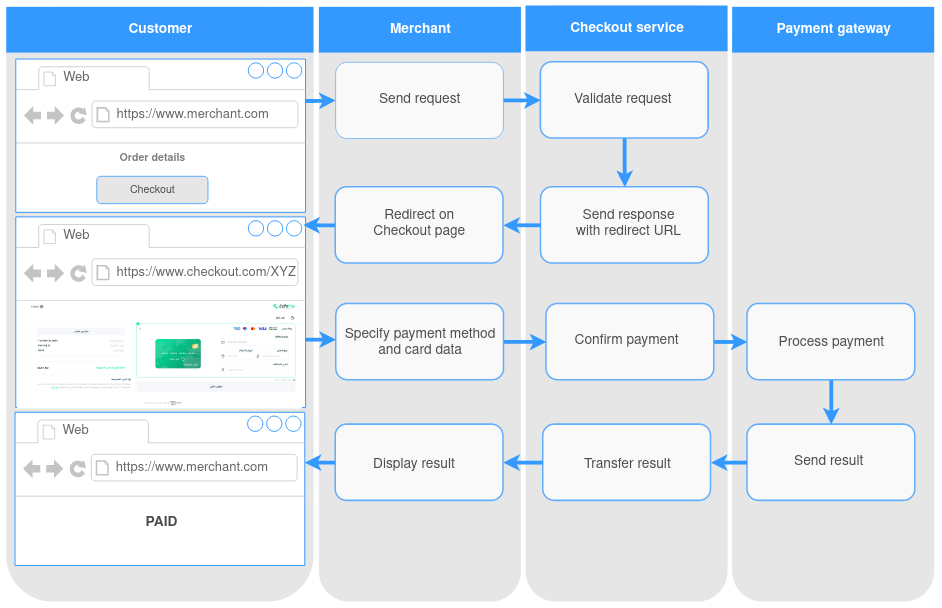

Checkout payment flow is shown below.

When a Customer wants to make a purchase on your site the following

happens:

- Customer places an order and initiates payment on the site.

- Site confirms the order and sends the payment processing request to the Checkout system with information about the order, payment and hash.

- Checkout system validates the request and sends to the site the response with the redirect link.

- The site redirects the Customer on the Checkout page by redirect link.

- Customer selects the payment method, enters the payment data and confirms the payment. The payment method will be specifying automatically If only one method is available.

- The payment processes at Payment Gateway.

- Payment Gateway sends a callback to the site with the payment result.

- The payment result is shown to the Customer.

The payment could be declined in case of invalid data detection.

Integration process#

Before you get an account to access Payment Platform, you must provide the following data to the Payment Platform administrator.

| Data | Description |

|---|---|

| Callback URL | URL which will be receiving the notifications of the

processing results of your request to Payment

Platform. It is mandatory if your account supports 3D-Secure. The length of Notification URL should not be more than 255 symbols. |

| Contact email | Email address of Responsible Person who will monitor transactions, conduct refunds, etc. |

With all Payment Platform POST requests at Notification URL the Merchant must return the string OK if he/she successfully received data or return ERROR.

You should get the following information from administrator to begin working with the Payment Platform.

| Data | Description |

|---|---|

| CLIENT_KEY | Unique key to identify the account in Payment Platform (used as request parameter). In the administration platform this parametercorresponds to the Merchant key field |

| PASSWORD | Password for Client authentication in Payment Platform (used for calculating hash parameter). In the administration platform this parameter corresponds to the Password field |

| PAYMENT_URL | URL to request the Payment Platform |

Callback Notification#

Checkout service sends the callback on the merchant notification_URL as a result of an operation.

You can receive the callback for the next operation types:

- SALE

- 3DS

- REDIRECT

- REFUND

- RECURRING

List of possible actions in Payment Platform#

When you make request to Payment Platform, you need to specify action that needs to be done. Possible actions are:

| Action | Description |

|---|---|

| Initiate | Creates SALE or AUTH transaction |

| Refund | Refund transaction |

| STATUS | Gets status of transaction |

| Recurring | Creates SALE or AUTH transaction using previously used cardholder data |

List of possible transaction results and statuses#

Result – value that system returns on request. Possible results are:

| Result | Description |

|---|---|

| SUCCESS | Action was successfully completed in Payment Platform |

| DECLINED | Result of unsuccessful action in Payment Platform |

| REDIRECT | Additional action required from requester (Redirect to 3ds) |

| ACCEPTED | Action was accepted by Payment Platform, but will be completed later |

| ERROR | Request has errors and was not validated by Payment Platform |

Status – actual status of transaction in Payment Platform. Possible statuses are:

| Status | Description |

|---|---|

| 3DS | The transaction awaits 3D-Secure validation |

| REDIRECT | The transaction is redirected |

| SETTLED | Successful transaction |

| REFUND | Transaction for which refund was made |

| DECLINED | Not successful transaction |

Callback parameters#

Notification endpoint must be of method POST and able to accept form-data as the content type.

Successful sale response (Card Payment) #

| Parameter | Description |

|---|---|

action |

SALE |

result |

SUCCESS |

status |

PENDING / PREPARE / SETTLED; only PENDING when

auth = Y

|

order_id |

Transaction ID in the Merchant's system |

trans_id |

Transaction ID in the Payment Platform |

trans_date |

Transaction date in the Payment Platform |

descriptor |

Descriptor from the bank, the same as cardholder will see in the bank statement |

recurring_token |

Recurring token (get if account support recurring sales and was initialization transaction for following recurring) |

schedule_id |

Schedule ID for recurring payments. It is available if schedule is used for recurring sale |

card_token |

If the parameter req_token was enabled Payment

Platform returns the token value |

amount |

Order amount |

currency |

Currency |

Unsuccessful sale response (Card Payment)#

| Parameter | Description |

|---|---|

action |

SALE |

result |

DECLINED |

status |

DECLINED |

order_id |

Transaction ID in the Merchant's system |

trans_id |

Transaction ID in the Payment Platform |

trans_date |

Transaction date in the Payment Platform |

descriptor |

Descriptor from the bank, the same as cardholder will see in the bank statement |

amount |

Order amount |

currency |

Currency |

decline_reason |

The reason why the transaction was declined |

hash |

Special signature, used to validate callback |

3D-Secure transaction response#

| Parameter | Description |

|---|---|

action |

SALE |

result |

REDIRECT |

status |

3DS / REDIRECT |

order_id |

Transaction ID in the Merchant's system |

trans_id |

Transaction ID in the Payment Platform |

trans_date |

Transaction date in the Payment Platform |

descriptor |

Descriptor from the bank, the same as cardholder will see in the bank statement |

amount |

Order amount |

currency |

Currency |

redirect_url |

URL to which the Merchant should redirect the Customer |

redirect_params |

Object of specific 3DS parameters. It is array if

redirect_params have no data. The availability

of the redirect_params depends on the data

transmitted by the acquirer. redirect_params

may be missing. It usually happens when

redirect_method = GET

|

redirect_method |

The method of transferring parameters (POST / GET) |

card |

Masked card details |

card_expiration_date |

The method |

Sale response (Apple Pay)#

| Parameter | Description |

|---|---|

id |

Transaction ID in the Payment Platform |

order_number |

Transaction ID in the Merchant's system |

order_amount |

Order amount |

order_currency |

Order currency |

order_description |

Order description |

hash |

Must be SHA1 of MD5 encoded string (uppercased): payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass |

type |

(sale/refund) |

status |

(success/fail) |

Sale response (Manafith)#

| Parameter | Description |

|---|---|

id |

Transaction ID in the Payment Platform |

order_number |

Transaction ID in the Merchant's system |

order_amount |

Order amount |

order_currency |

Order currency |

order_description |

Order description |

hash |

Must be SHA1 of MD5 encoded string (uppercased): payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass |

type |

(sale/refund) |

status |

(success/fail) |

source |

(manafith) |

PAYMENT OPERATIONS#

Initiate request#

Payment Platform supports two main operation type: Single Message System (SMS) and Dual Message System (DMS).

SMS is represented by SALE transaction. It is used for authorization and capture at a time. This operation is commonly used for immediate payments.

DMS is represented by AUTH and CAPTURE transactions. AUTH is used for authorization only, without capture. This operation used to hold the funds on card account (for example to check card validity).

SALE request is used to make both SALE and AUTH transactions.

If you want to make AUTH transaction, you need to use parameter auth with value Y.

This request is sent by POST as Form-Data in the background (e.g. through PHP CURL).

Initiate request

POST https://api.edfapay.com/payment/initiate Request parameters#

| Parameter | Description | Values | Required field |

|---|---|---|---|

action |

Sale | SALE | + |

edfa_merchant_id |

Unique key (client_key) Edfapay merchant key - UUID format value | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | + |

order_id |

Transaction ID in the Merchants system String up to 255 characters | String up to 255 characters | + |

order_amount |

The amount of the transaction | Numbers in the format XXXX.XX Pay attention that amount format depends on currency exponent. If exponent = 0, then amount is integer (without decimals). It used for currencies: CLP, VND, ISK, UGX, KRW, JPY. If exponent = 3, then format: XXXX.XXX (with 3 decimals). It used for currencies: BHD, JOD, KWD, OMR, TND. |

+ |

order_currency |

Currency | 3-letter code | + |

order_description |

Description of the transaction (product name) | String up to 1024 characters | + |

req_token |

Special attribute pointing for further tokenization | Y or N (default N) | - |

payer_first_name |

Customer's name | String up to 32 characters | + |

payer_last_name |

Customer's surname | String up to 32 characters | + |

payer_middle_name |

Customer's middle name | String up to 32 characters | - |

payer_birth_date |

Customer's birthday | format yyyy-MM-dd, e.g. 1970-02-17 | - |

payer_address |

Customer's address | String up to 255 characters | + |

payer_address2 |

The adjoining road or locality (if required) of the сustomer's address | String up to 255 characters | - |

payer_country |

Customer's country | 2-letter code | + |

payer_state |

Customer's state | String up to 32 characters | - |

payer_city |

Customer's city | String up to 32 characters | + |

payer_zip |

ZIP-code of the Customer | String up to 10 characters | + |

payer_email |

Customer's email | String up to 256 characters | + |

payer_phone |

Customer's phone | String up to 32 characters | + |

payer_ip |

IP-address of the Customer | XXX.XXX.XXX.XXX | + |

term_url_3ds |

URL to which Customer should be returned after 3D-Secure | String up to 1024 characters | + |

recurring_init |

Initialization of the transaction with possible following recurring | Y or N (default N) | - |

auth |

Indicates that transaction must be only authenticated, but not captured | Y or N (default N) | - |

hash |

Special signature to validate your request to Payment Platform | See Initiate signature | + |

*This field becomes optional if card_token is

specified

If the optional parameter card_token and card data are

specified, card_token will be ignored.

If the optional parameters req_token and

card_token are specified, req_token will be

ignored.

Request parameters#

Request with format-data

{

curl --location 'https://api.edfapay.com/payment/initiate' \

--form 'action'="SALE"

--form 'edfa_merchant_id'="xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--form 'order_id'="ORD001"

--form 'order_currency'="SAR"

--form 'order_description'="An order"

--form 'req_token'="N"

--form 'payer_first_name'="FisrtName"

--form 'payer_last_name'="LastName"

--form 'payer_address'="example@example.com"

--form 'payer_country'="SA"

--form 'payer_city'="Riyadh"

--form 'payer_zip'="12221"

--form 'payer_email'="example@example.com"

--form 'payer_phone'="966565555555"

--form 'payer_ip'="176.44.76.222"

--form 'term_url_3ds'="https://successorfailurl.com"

--form 'auth'="N"

--form 'recurring_init'="N"

--form 'hash'="xxxxxxx-xxxx-xxxxxx"

}Response parameters#

Response with Json format

{

"redirect_url" : "https://pay.edfapay.com/merchant/checkout/Order110/xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

}Recurring request#

Recurring payments are commonly used to create new transactions based on already stored cardholder information from previous operations. This request is sent by POST.

Recurring request

POST https://api.edfapay.com/payment/recurring Request parameters#

| Parameter | Description | Values | Required field |

|---|---|---|---|

gwayId |

String , Public transaction id of Payment Gateway | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | + |

order_id |

String , Order Id of merchant system | UUID format value | + |

edfapay_merchant_id |

String , Merchant Key indentifier xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | UUID format value | + |

amount |

Product price. Format: XX.XX Pay attention that amount format depends on currency exponent. | If exponent = 0, then amount is integer (without decimals).

It used for currencies: CLP, VND, ISK, UGX, KRW, JPY.

If exponent = 3, then format: xx.xxx (with 3 decimals). It

used for currencies: BHD, JOD, KWD, OMR, TND.

Example: 0.19 |

+ |

hash |

Special signature to validate your request to payment platform | See Recurring Signature | + |

payer_ip |

Payment Payer ip platform | Example: 172.34.34.12 | + |

Request parameters#

Request with Json format

curl --location 'https://api.edfapay.com/payment/recurring' \

--date '{

"merchant_id": "b1efc42a-67d3-4bdc-8382-7059bb665036",

"action": "RECURRING_SALE",

"order_id": "OrderID",

"primary_order_id": "Abdul00012",

"amount":"1.00"

"recurring_token": "58ccf36e-466f-11ee-840d-7a6dc1121caa"

"order_description": "Recurring test order",

"payer_ip": "176.44.76.222",

"hash": "hash-value",

}Response parameters#

Response with Json format

{

"Status":"settled"

"payment_id": "xxxx-xxxx-xxxx-xxx"

"date" : "2023"-09-22 19:33:01",

"order": {

"number": "1122",

"amount: "700",

"currency": "SAR",

"description: order description"

},

}Refund request#

To make refund you can use Refund request. Use payment public ID from Payment Platform in the request.

Refund request

POST https://api.edfapay.com/payment/refund Request parameters#

| Parameter | Description | Values | Required field |

|---|---|---|---|

edfapay_merchant_id |

Unique key (client_key) Edfapay merchant key - Json value | xxxxx-xxxxx-xxxxx | + |

gwayId |

String , Public transaction id of Payment Gateway | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | + |

trans_id |

Transaction ID in the Payment Platform | String xxxx-xxxx-xxxx-xxx | + |

order_id |

Transaction ID in the Merchants system String up to 255 characters | String up to 255 characters | + |

hash |

Special signature to validate your request to Payment Platform | See Refund Signature | + |

payer_ip |

Cleint IP | String Example: 172.34.34.12 | + |

amount |

String Amount to refund. It is required for particular refund. If amount is not specified the full order amount is settled by default. | Example: 0.19 | + |

Request parameters#

Request with Json format

curl --location 'https://api.edfapay.com/payment/refund' \

--date '{

"edfa_merchant_id": "b1efc42a-67d3-4bdc-8382-7059bb665036",

"gwayId": "xxx-xxx-xxx-xxx-xxxx",

"order_id": "OrderID",

"amount":"1.00"

"payer_ip": "176.44.76.222",

"hash": "hash-value",

}Response parameters#

Response with Json format

{

"StatusCode : 200"

"responseBody": {

"result" : "accepted",

"payment_id":"xxxxxxxx-xxxxx-xxxxxxx-xxx"

}

}

Status request#

To get order status you can STATUS request. Use payment gway_Payment_Id from Payment Platform in the request.

Status request

POST https://api.edfapay.com/payment/status Request Parameters#

| Parameter | Description | Values | Required |

|---|---|---|---|

merchant_id |

Unique key (client_key) Edfapay merchant key - Json value | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | + |

gway_Payment_Id |

String , Public transaction id of Payment Gateway | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx | + |

order_id |

String , Order Id of merchant system | OrderNumber10 | + |

order_id |

Transaction ID in the Clients system | String up to 255 characters | + |

hash |

String | See Initiate Signature | + |

Request parameters#

Request with Json format

curl --location 'https://api.edfapay.com/payment/status' \

--date '{

"edfa_merchant_id": "b1efc42a-67d3-4bdc-8382-7059bb665036",

"order_id": "OrderID",

"payer_ip": "176.44.76.222",

"hash": "hash-value",

}Response parameters#

Response with Json format

{

"StatusCode : 200"

"responseBody": {

"date" : "2023"-09-22 19:33:01",

"status":"settled"

"order": {

"number": "1122",

"amount: "700",

"currency": "SAR",

"description: order description"

},

"customer: {

"name": "Client Name "

"email":"Client Email

},

"payment_id": :xxxxx-xxxxxx-xxxxxx-xxxxx

}

}Signature#

Sign is signature rule used either to validate your requests to payment platform or to validate callback from payment platform to your system.

Initiate Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(id.order.amount.currency.description.PASSWORD)))

// Use the CryptoJSvar

Example for JsVar to_md5 = order.number + order.amount + order.currency + order.description + merchant.pass;

//Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Recurring Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(recurring_init_trans_id.recurring_token.order_id.amount.description.merchant.pass)))

// Use the CryptoJSvar

Example for JsVar to_md5 = recurring_init_trans_id + recurring_token + order.number + order.amount + order.description + merchant.pass;

//Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Refund Signature #

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JsVar to_md5 = payment.id + amount + merchant.pass;

//Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Status Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(recurring_init_trans_id.recurring_token.order_id.amount.description.merchant.pass)))

// Use the CryptoJSvar

Example for JsVar to_md5 = payment.id + amount + merchant.pass;

//Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Errors#

In case of an error you get synchronous response from Payment Platform:

| Parameter | Description |

|---|---|

result |

ERROR |

error_message |

Error message |

error_code |

Error code |

The list of the error codes is shown below.

| Code | Description |

|---|---|

| 204002 | Enabled merchant mappings or MIDs not found. |

| 204003 | Payment type not supported. |

| 204004 | Payment method not supported. |

| 204005 | Payment action not supported. |

| 204006 | Payment system/brand not supported. |

| 204007 | Day MID limit is not set or exceeded. |

| 204008 | Day Merchant mapping limit is not set or exceeded. |

| 204009 | Payment type not found. |

| 204010 | Payment method not found. |

| 204011 | Payment system/brand not found. |

| 204012 | Payment currency not found. |

| 204013 | Payment action not found. |

| 204014 | Month MID limit is exceeded. |

| 204015 | Week Merchant mapping limit is exceeded. |

| 208001 | Payment not found. |

| 208002 | Not acceptable to request the 3ds for payment not in 3ds status. |

| 208003 | Not acceptable to request the capture for payment not in pending status. |

| 208004 | Not acceptable to request the capture for amount bigger than auth amount. |

| 208005 | Not acceptable to request the refund for payment not in settled or pending status. |

| 208006 | Not acceptable to request the refund for amount bigger than payment amount. |

| 208008 | Not acceptable to request the reversal for amount bigger than payment amount. |

| 208009 | Not acceptable to request the reversal for partial amount. |

| 208010 | Not acceptable to request the chargeback for amount bigger than payment's amount. |

| 205005 | Card token is invalid or not found. |

| 205006 | Card token is expired. |

| 205007 | Card token is not accessible. |

| 400 | Duplicate request. |

| 400 | Previous payment not completed. |

Sample of error-response

{"result": "ERROR", "error_code": 100000, "error_message": "Request data is invalid.", "errors": [ { "error_code": 100000, "error_message": "card_number: This value should not be blank." }, { "error_code": 100000, "error_message": "card_exp_month: This value should not be blank." }, { "error_code": 100000, "error_message": "card_exp_year: This value should not be blank." }, { "error_code": 100000, "error_message": "card_cvv2: This value should not be blank." }, { "error_code": 100000, "error_message": "order_id: This value should not be blank." }, { "error_code": 100000, "error_message": "order_amount: This value should not be blank." }, { "error_code": 100000, "error_message": "order_amount: This value should be greater than 0." }, { "error_code": 100000, "error_message": "order_currency: This value should not be blank." }, { "error_code": 100000, "error_message": "order_description: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_first_name: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_last_name: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_address: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_country: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_city: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_zip: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_email: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_phone: This value should not be blank." }, { "error_code": 100000, "error_message": "payer_ip: This value should not be blank." }, { "error_code": 100000, "error_message": "term_url_3ds: This value should not be blank." } ]}Testing#

You can make test requests using data below. Please note, that all transactions will be processed using Test engine.

| Card number | Card expiration date (MM/YYYY) | Testing / Result |

|---|---|---|

| 4111111111111111 | 01/2025 | This card number and card expiration date must be used for

testing successful sale Response on successful SALE request: {action: SALE, result: SUCCESS, status: SETTLED}

Response on successful AUTH request: {action: SALE, result: SUCCESS, status: PENDING}

|

| 2223000000000007 | 01/2039 | This card number and card expiration date must be used for

testing Response on SALE/AUTH request: {action: SALE, result: REDIRECT, status: REDIRECT}Return to the system: {action: SALE, result: DECLINED, status: DECLINED}

|

| 5123450000000008 | 01/2039 | This card number and card expiration date must be used for

testing Response on SALE/AUTH request:: {action: SALE, result: REDIRECT, status: REDIRECT}Return to the system: {action: SALE, result: DECLINED, status: DECLINED}

|

| 4508750015741019 | 01/2039 | This card number and card expiration date must be used for

testing Response on SALE/AUTH request: {action: SALE, result: REDIRECT, status: REDIRECT}Return to the system: {action: SALE, result: DECLINED, status: DECLINED}

|